|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Chapter 13 Bankruptcy Payment Calculator: A Guide to Understanding and Usage

Introduction to Chapter 13 Bankruptcy

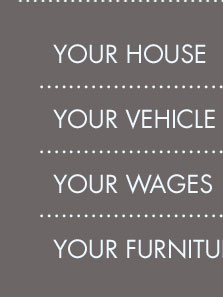

Chapter 13 bankruptcy is a legal process that allows individuals with a regular income to restructure their debts. Instead of liquidating assets, debtors create a repayment plan to pay back creditors over a period of three to five years. This option can be beneficial for those who wish to retain their property while addressing their financial obligations.

How a Chapter 13 Bankruptcy Payment Calculator Works

A Chapter 13 bankruptcy payment calculator is a tool designed to help debtors estimate their monthly payments under a Chapter 13 plan. These calculators take into account various factors such as income, expenses, and debt obligations to provide an estimated payment amount.

Factors Considered in Calculations

- Income: Your current monthly income is a primary factor in determining your payment plan.

- Expenses: Necessary expenses like housing, utilities, and transportation impact the payment amount.

- Secured and Unsecured Debts: Different types of debts are treated differently in the repayment plan.

Benefits of Using a Payment Calculator

Using a Chapter 13 bankruptcy payment calculator offers several advantages:

- Clarity: It provides a clear picture of what your financial commitment will be during the repayment period.

- Planning: Helps in planning your finances by understanding how much you need to allocate each month.

- Comparison: Allows for comparison of different scenarios by adjusting inputs to see how changes affect payments.

Steps to Using a Chapter 13 Payment Calculator

Follow these steps to use a Chapter 13 bankruptcy payment calculator effectively:

- Gather all necessary financial information, including income, expenses, and debt details.

- Input the information into the calculator accurately.

- Review the estimated payment and make adjustments if needed.

- Consult with a bankruptcy attorney to discuss the results and next steps.

If you're considering filing bankruptcy in Oregon, it's important to understand the local laws and how they may affect your case.

Frequently Asked Questions

What is the main advantage of Chapter 13 over Chapter 7 bankruptcy?

The primary advantage of Chapter 13 is the ability to retain assets while repaying debts, unlike Chapter 7 which may involve asset liquidation.

Can I use a Chapter 13 payment calculator without a lawyer?

Yes, you can use the calculator independently, but consulting a lawyer is recommended for accurate legal advice and to ensure all factors are correctly considered.

Are Chapter 13 payment plans flexible?

Yes, payment plans can be adjusted under certain circumstances, such as changes in income or financial status, with court approval.

When considering filing bankruptcy in PA, it's crucial to understand state-specific nuances to effectively navigate your financial recovery.

You will receive a free Chapter 13 qualification estimate based on the US bankruptcy forms. Many attorneys prefer context before a free consultation.

To figure out your monthly payment amount, you'll start by calculating the bills you must pay in full, which are your secured and priority debts.

This calculator estimates your minimum monthly Chapter 13 payment by calculating your secured and priority paymentsamounts that all Chapter 13 filers must pay.

![]()